by

Daniel Burstein, Director of Editorial Content

In the

MarketingSherpa Ecommerce Benchmark Study survey, we asked:

Q. Which statement best describes the process your organization uses to plan, execute and measure the performance of ecommerce marketing programs?And,

Q. What was your company’s revenue in 2012 and 2013?We then combined responses to these questions with the respondent’s

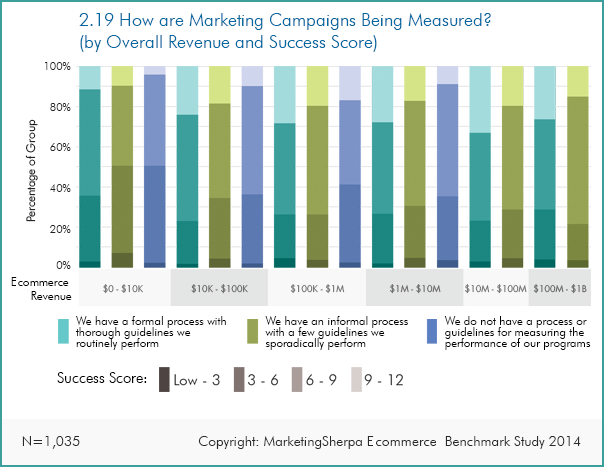

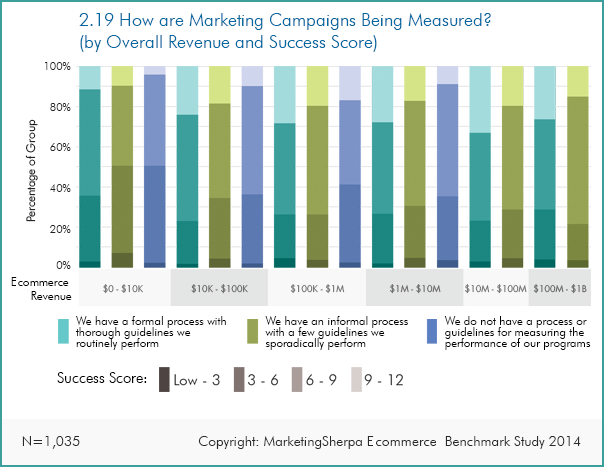

success score to create the chart below, which is followed in this article by an analysis of the data to help you interpret this information:

Click here to see a printable version of this chart

Valuable insights don’t happen by accident

Metrics. Analytics. Data. What we’re really talking about when we say these words is raw information that represents an interaction with a customer or another form of customer behavior.

Of course, most companies don’t care about this information. Not really.

They don’t want information; they want insights. They want an understanding of what customers are doing, why they’re doing it, and what they will do next.

To get that insight, they need more than a tool or a platform. They need a formal process with thorough guidelines that a well-trained team consistently performs to derive reliable business intelligence.

If you don’t have that team and process in place already, and you don’t have the resources to make it happen, the above chart is an excellent justification to help you secure the budget you need.

More successful companies tend to have more rigorous data analysis

The above chart shows that — across all revenue levels — the companies that have built a formal process around marketing campaign measurement have consistently been more successful than the companies that haven’t.

Bigger companies tend to have more resources and a greater ability to follow a formal process. In fact, we had too few responses from companies with more than $10 million in revenue that answered, "We do not have a process or guidelines for measuring the performance of our programs," to include them in the chart.

However, size isn’t everything. Even among companies with similar amounts of revenue, there was a noticeable difference in their success score based on how rigorously they analyzed their metrics.

For example, 33% of companies with revenue between $10 million to $100 million that have a formal process with thorough guidelines they routinely perform had a success score of 9-12.

In companies that had the same amount of revenue, but only had an informal process with a few guidelines they sporadically perform, only 19% had a success score of 9-12 (among the most successful ecommerce companies in the marketplace, according to their revenue growth, margin and 10 other data points in our

weighted success score model.)

As one Benchmark Study survey respondent lamented, "Most of our clients only want a website. Almost all of our clients have no understanding of the importance of creating a strategic marketing plan that integrates the website as a part of a traffic and conversion process … they also don't understand the value and benefits of analytical tools on the back end to measure results and to modify marketing campaigns and testing for better conversion."

It’s only getting more complex

When asked about their biggest challenges, Benchmark Survey study participants’ responses pointed to the growing complexity of measurement, with answers such as "multi-channel integration, data flow, staff buy-in for initiatives and using data to make actionable decisions" and "attribution modelling and multi-channel marketing."

The growth of digital marketing initially helped marketers track and measure the behavior and performance of their marketing.

For example, an online banner ad may or may not have performed better (especially when branding is considered) than a print ad. However, many marketers invested in them simply because they seemed to perform better. In other words, more sales or leads could be directly attributed to the digital ad thanks to the ease of online tracking.

As devices have multiplied, it has become harder to get an understanding of which channels have really influenced purchases and which ones are simply the last thing a person happened to see before they bought.

It has also been harder to customize experiences for customers across the many ways they now interact with your company, since you may know them on one device but not on another.

"In 2015, the conversation for marketers is going to focus more on digital attribution and the addressable consumer. Both are going to require the marketer to not only increase their knowledge about these emerging realities, but it’s going to require technology to move faster than ever before," said Ryan Phelan, Vice President, Global Shared Services,

Acxiom.

He continued, "Acquisition strategies are going to have to change, as well as adopting onboarding that touches the consumer through not only email but online addressable channels. Companies are going to be required to spend massive amounts of money to identify those audiences that have not been identifiable before. 2015 is a pivot year, and I think a massive one for marketers to pivot just as fast."

Related Resources

Subscribe to MarketingSherpa Chart of the Week — Learn from your peers and experts

The MarketingSherpa Ecommerce Benchmark Study — Download your free copy

Marketing Analytics Benchmark Report — Free excerpt

Marketing Research Chart: What metrics should you track?Measuring Content Marketing: How to measure results, find gaps and grab opportunitiesA/B Testing: How to improve already effective marketing (and win a ticket to Email Summit in Vegas) — Deadline is January 13, 2015