by

Daniel Burstein, Director of Editorial Content

In the

MarketingSherpa Ecommerce Benchmark Study survey, we asked marketers:

Q. What percent of your marketing budget was spent on each of the following in 2013?We also asked:

Q. Please indicate the 2013 level of the following metrics and their ongoing trend.

One of the trends was "acquisition cost per customer."

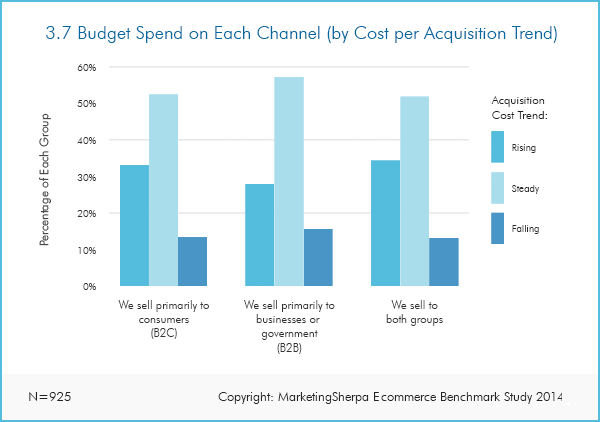

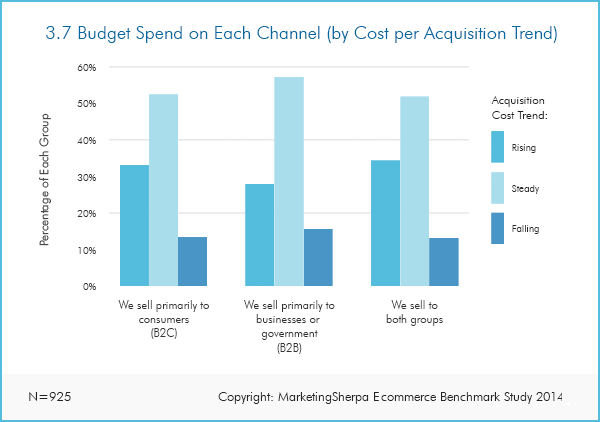

We then compared the responses to create the chart featured in this article. This chart is followed by an analysis of the search-related channels:

Click here to see a printable version of this chart

Paid search is both effective and expensive for customer acquisition

Paid search received the largest share of the budget for marketers.

However, those marketers who reported a steady cost per acquisition trend (CPA) reported that paid search comprised an average of 14% of their budgets, while companies with rising (20% of budget) and falling (19% of budget) invested more of their budgets in paid search.

Is paid search getting split between the haves and have nots? That is, are the companies that invest a significant portion of their budget in paid search receiving significant margins, while other companies that allocate a smaller portion of their budget are finding it difficult to keep up with the expense? Some marketers responded to the survey by praising the success of paid search, particularly in helping with SEO challenges:"Had to move away [from] organic SEO. Relied more on other channels such as PPC (pay-per-click advertising), Amazon, and email."

Others complained of the increasing cost which likely hurt cost per acquisition:

"Paid search operated at a loss, cut it out of budget."

However, some marketers took an entirely different approach to advertising:

"Hard copy advertising does not work anymore, so our primary aim is to engage visitors through the work that we do around the people and products we sell … We have made lots of changes to the way the website looks and added additional features — all meant to increase the user experience and promote interaction as part of our drive to give the website a human feel and connect with our members and their customers. To compete we have to be different, and that is what we are rolling out now, having put the last 18 months down to market research."

SEO (Search Engine Optimization) spending steady no matter how expensive customer acquisition is becoming

Paid search’s "free" cousin — SEO — was one of the top budgeted tactics as well.

This is because, of course, the traffic companies derive from SEO is not free at all. It takes a heavy investment in content, IT and even an SEO-specific agency to out-optimize competitors.

SEO made up 11% of the budget for marketers with rising and steady CPAs and a slightly higher 12% for marketers with falling CPAs.

This is likely an area of the budget that marketers feel like they must invest in no matter how expensive customer acquisition is getting — a sort of SEO arms race with the competition.

That is, search engine results pages are a zero-sum game. If a company cuts their investment in SEO, does that leave the door open for a competitor to rise to the top?

With so much control in the hands of search engines and the sudden changes that can come from algorithm changes, marketers are seeing the benefit of diversity of budget investments. As one marketer replied, "Organic visits dropped off, but SEO adjustments are being made. Glad not all our eggs were in one basket."

For this reason, SEO and paid search can make an effective pair. As this marketer advised, "Much of our success has been maintaining clean SEO and SEM (search engine marketing) data. We have focused primarily on higher conversion and lower cost of acquisition channels and cut off channels, which do not convert. Site optimization for performance and speed of delivery has also been key."

Product listing ads and rising cost per acquisition

If you’re unfamiliar with the term, product listing ads (PLAs) — now referred to as Shopping campaigns by Google — are served up when a customer searches for a product on Google, or on Google Shopping, and features a picture of the product, the name of the store and the price of the product.

Similar services are offered by PriceGrabber, Amazon and others.

They are, essentially, another way to invest in search marketing, particularly when a customer is quite far down the decision-making funnel — namely, when they are searching for a specific product.

For that reason, these ads can be effective. As one respondent noted, "We also use price comparison websites, which deliver a very high return on investment. For small companies such as ours, we need to focus on one or two types of advertising. We use price comparison and paid search engine listings. If there was a very simple and easy to use retargeting or affiliate system, we would definitely give it a try to evaluate its ROI."

However, reaching these motivated customers comes at a cost. As you can see in the data, more of the budget is being invested in PLAs by those experiencing rising or steady CPAs — 5% of budget for both — than those reporting falling CPAs — only 3% of budget.

Could this be due to the cost of PLAs? As one respondent noted, her biggest challenge was "maintaining a profitable balance between CPA and the profit margin on our product listing ads."

Where should you invest your marketing budget? There are no easy answers. As one apathetic respondent indicated, if you can figure out how to reach potential customers in a more cost-effective way, it will give you a leg up over the competition:

"Not sure anymore what is relevant and what price to pay, like Twitter. Also disappointed about SEO and paid ads. Still looking for some expert guidance. Competitors face the same problem, so it is OK, for now."

Related Resources

MarketingSherpa Ecommerce Benchmark StudyEcommerce Research Chart: ROI on marketing spend Ecommerce Research Chart: Website usability and revenue growth Content Marketing: How a farm justifies premium pricing Lead Generation: Content and email combine for high-quality list building