by

Kayla Cobb, Reporter

THE CUSTOMER

SUPPLY.com, an ecommerce wholesaler of lighting, kitchen and bath fixtures, serves both B2C and B2B customers. In the past, SUPPLY.com's customer base has focused on the consumer side, namely homeowners. However, its focus has recently shifted to include professionals more involved at the middle point between businesses and customers.

"Traditionally, our customer base has been, for the most part, people renovating their own homes — the homeowners themselves. But, over the years, we’ve seen the value in trying to not quite get into distribution … but to focus on, like, the halfway between businesses and customers," David Gallmeier, Marketing and Development, SUPPLY.com, said. "It’s changing a little bit, and by 'changing' I mean more standing."

CHALLENGE

SUPPLY.com faced a problem that is similar to one many companies face — large advertising costs and little to show for the expense. "We just had a history of bad maintenance, bad chain — both in-house and out of house through consulting services and other firms and other products we’ve used," Gallmeier explained.

After several failed attempts to get the company's spending on advertising to a profitable level, the owners of SUPPLY.com gave Gallmeier the task of reining in these spends. This large undertaking was essentially the only project he worked on for a year and a half.

"I was tasked with taking over our advertising accounts and basically pulling them into a place of profitability as well as the entire retail section of our company at the time, which wasn’t really at a profitable state because of advertising costs that had just gotten out of control," he said.

Gallmeier realized that there was not an effective system in place to determine which advertisements were creating a profitable return and which weren't. Though this is a straightforward enough problem to solve when it comes to online interactions, a large portion of SUPPLY.com's sales and leadss funnel into its call center. There was no way to track which ads these calls were coming from.

"I have access to all the information, but when [customers] call into the call center, all I have is a sales order and I have no idea which advertisements it came in off of," he explained. "All I can do is infer — looking at the sales order and the product that we sold — where the advertisement may have been."

CAMPAIGN

Without knowing exactly how profitable each advertisement was, Gallmeier realized that he was missing a huge piece of information and that the company was potentially overspending on advertising. While he did have some idea of the profitability of the company's online advertisements, he knew far less when it came to sales made through the call center.

To monitor the profitability of the company's various marketing spends, Gallmeier launched a thorough keyword tracking campaign that included online and call center sales.

"We were able to attribute the majority — more than half of our sales — but there was too much uncertainty in the model without tracking in the call center to make any aggressive cuts without risking losing a lot of sales," he said.

Gallmeier enlisted a vendor to help understand which advertisements were failing so that the team could start becoming aggressive about cutting unnecessary advertising costs.

Learn how SUPPLY.com's aggressive advertising rebuilding campaign led to a 60% decrease in online spending without a decrease in sales.

Step #1. Evaluate the current system

In order to determine what to cut from SUPPLY.com's large and ineffective marketing spend, Gallmeier first had to assess the current system.

"I realized that I can see where a lot of our advertisements are making money, and I’ve seen all of these advertisements in the red ... yet I have this big segment of our sales where we’re just not able to see where it came from," he said. "I wasn’t really confident enough at that point to start cutting advertisements aggressively.”

Even though SUPPLY.com was able to attribute more than half of its sales, there was too much uncertainty in the company's current marketing model to start a major transition. This was largely due to the fact that the team had no way of tracking which ads resulted in call center sales.

Originally, Gallmeier attempted to use basic arithmetic to fill in the missing sales gaps. He looked at SUPPLY.com's Web traffic, PPC revenue and total sales and used cross multiplication on a large scale to fill in the sale attribution gaps. While this approach did give him an idea of the company's marketing weaknesses, it was far from a complete picture.

"Basically, once I had that whole model built out, what I realized is that I’m looking at maybe, like, 65% of the sales that [are] going on," he said.

Step #2. Rebuild online ads

After realizing that SUPPLY.com was unable to account for 30-40% of its sales revenue, Gallmeier set out to rebuild the tracking system for its online ads.

"The first step that I took was to basically structure and rebuild all of our online advertisements in a programmatic way," he said.

This essentially meant taking the company's entire product catalog and adapting it to online campaigns in a way that was easier to track. This rebuild was done in part to better organize the ads that were currently running, but it was also done with a bigger plan in mind.

According to Gallmeier, he was "… structuring the campaigns in a way so that I could then, at a later point, put them into a marketing model that I could use to measure the performance of those campaigns."

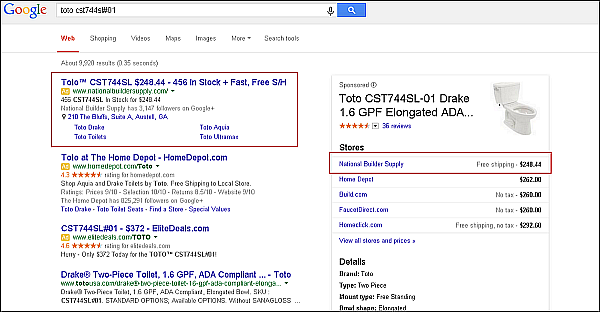

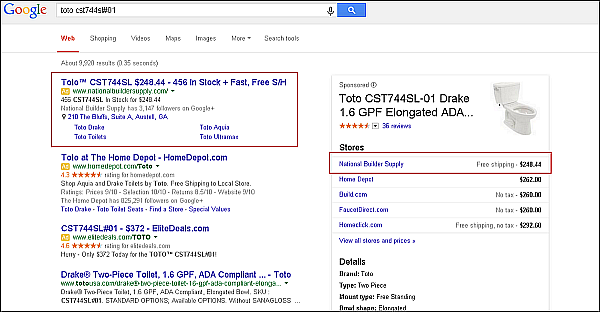

The specific online advertising channels SUPPLY.com rebuilt included banner advertisements, display advertisements and remarketing efforts. However, the company also had some experience with

keyword and product listing advertising.

Click here to see the full version of this creative sample

"All of our legacy stuff, for the most part, it started out as keywords, and then, several years ago, Google started introducing and pushing product listing ads," he said.

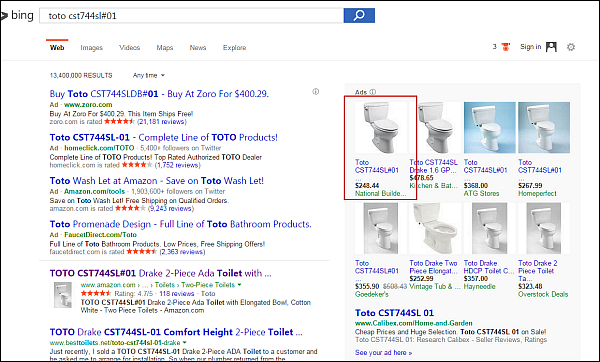

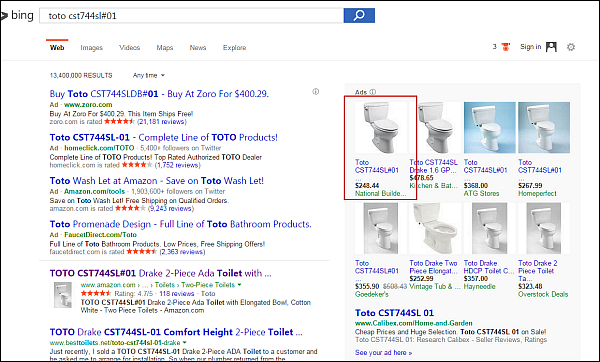

Through SUPPLY.com's experience, Gallmeier witnessed a shift in keyword advertising. When the advertising efforts first started out, Gallmeier said that there was a 60% to 40% split when it came to investing into keywords versus product listing ads. Now, he says the split is more along the lines of 70% to 30% with traffic, PPC expenses and revenue profits coming from

product listing advertisements.

"I have seen a real dry-up of profitability in the keyword side of online ads," he said. "And when I say 'keywords,' I’m referring generally to what you see on Google, not necessarily the display ads."

Click here to see the full version of this creative sample

Step #3. Automate the process of building and tracking campaigns

Because the campaigns SUPPLY.com implemented were on such a large scale, Gallmeier had to find a way to automate the process.

"At a very discreet level, we have keyword campaigns in Google, for example, that have more than 10,000 ad groups, and each of those ad groups might have up to a dozen keywords," he explained.

Automating this process also allowed the PPC campaigns to run more effectively, as the team was now "building campaigns and being able to track them on a scale that obviously couldn’t be done manually," he said.

Step #4. Implement a call tracking campaign

Once a more accurate process was put into place for the online advertisements, Gallmeier then had to focus on the biggest gap in the company's marketing strategy — tracking the advertisements that led to its call center sales.

Using a vendor, SUPPLY.com installed a site code that allowed the team to keep track of which advertisement campaigns customers were calling from. The way a typical website is set up, customers are given a single phone number that is featured on the site. When customers call this site-specific number, it can indicate that there is traffic on the site. However, using this single number does not indicate whether or not the sessions currently browsing the site are coming from the customer that is calling at that time. This call confusion was relieved once Gallmeier implemented a call tracking solution.

"What [our vendor] does is install some client-side code on your site that basically allocates to every unique visitor their own phone number," he said.

When a visitor first goes to SUPPLY.com's site,

a phone number with the area code (877) initially appears in the top right corner of the page. This number quickly changes to a user-specific number, chosen from a pool of hundreds of numbers, which remains on the site for the duration of the visitor's session.

Click here to see the full version of this creative sample

Customers are then directed to SUPPLY.com's customer service line. This system allows the company to directly track and link specific Web traffic to specific calls.

"I can quantify advertisements that come in on the Web traffic. I can also figure out which phone calls in our call center are generating sales," he said.

Once the missing piece of call center sales was added to the total sales puzzle, Gallmeier was then able to go in, identify and organize the campaigns and determine which advertisements were worth their investment.

"I’ve designed my own kind of ID and tagging system for all of our URLs," he explained. "Since I’ve generated all the online advertisements, I basically have identifiers in all the URLs. Any time someone clicks to our site, I can tell whether or not they’re coming off of a PPC campaign, and I can tell exactly which campaign, as well as just a keyword that they’re coming in on."

The team sees the customer's landing page URL as well as some Google UTM cookies that can then be connected to a Web session, he explained.

"We do all of it on our back end … I get the URLs that these calls came in on, and so, on my end, I can join the PPC metrics onto the URLs, and I can also join the sales from that phone call, if there were any, onto the call record," he said.

After determining where the call center sales were coming from and creating this attribution model, the team developed a much more complete view of their advertising structure. According to Gallmeier, "having that piece of the attribution model makes the difference for me being able to aggressively cut advertisements, knowing that they’re not profitable, without sacrificing sales in the call center."

Step #5. Build an in-house model

In order to continue the progress he made during this year and a half project, Gallmeier applied what he learned throughout the entire project to create an in-house revenue recognition model. Building this model was more of a major ongoing project than a final step.

This model required him to gain buy-ins from the company, specifically due to the time and effort creating this in-house revenue recognition model required. This is where Gallmeier's background in computer science came into play: "In my case, it wasn't a difficult sell since I designed and implemented the entire system myself."

The project has been built with on-premises software (on-prem). Mostly, it relies on a SQL Server, a relational database management system from Microsoft, as well as the ETL tools from Microsoft's data stack.

"The rest is code that I've written to pull data from sources like [Google] AdWords and Bing Ads," he said. "We use 3CX for our call center's phone system, which I pull from the built-in 3CX database to our own system via Microsoft's SSIS, and from there I join the phone records to data from [our vendor] and the rest of our data warehouse."

Gallmeier's advice to businesses thinking about creating their own in-house models is to build out the model yourself. By not relying on a vendor, be prepared to make the technical investment an in-house model requires.

He also advises figuring out what you are losing and making with each sale, outside of the advertising cost, and to "reconcile reports from the various advertisers that you’re paying to figure out how much money you’re spending each day, on each campaign, on each advertising unit."

"The model we’ve built in-house, that was my project and why it took me quite some time to see the whole thing through, but that was an in-house effort," he added.

RESULTS

As a result of these efforts, SUPPLY.com was able to cut its overall online spending by 60% while still maintaining the same level of sales.

According to Gallmeier, "We’ve seen a steep decline in the profitability of what used to be the mainstay of our online advertising profile, which is the search keywords — the advertisements that show up on Google, on Bing, what people are typing into search engines."

"For February and April … even March and April when I first started sharing this story, there was a 60% drop in overall PPC and not seeing a decline in sales. Overall sales remained flat during that period of time," he explained.

When asked what he learned from this project, Gallmeier emphasized the importance of data.

"I guess, honestly, the job of controlling online PPC advertising spend isn’t as hard if you’ve got access to the necessary data," he said. "Keeping advertising [spending] under control on your site is relatively trivial once you build out the proper reporting."

When he was first charged with this project, "it was a pretty intimidating project. I didn’t really know how it was going to conclude, but I guess that was the biggest takeaway. [With] the proper reporting and ... the proper architecture, it’s not that hard to reign Google, or any online advertisers … " he said.

Sources

SUPPLY.comCallRail (SUPPLY.com's vendor)

Creative Samples

- Google keywords and product ad listing

- Bing product listing

- Call tracking example

Related Resources

PPC Marketing: Call tracking increases leads 98%, decreases CPA 43%B2B Marketing: Optimized PPC program increases revenue 100%Email Marketing: Expedia Cruise Ship Centers uses data-triggered human interaction to increase bookings 81%