by

Erin Hogg, Reporter

Jefferson National is an innovative financial services company started by the leaders of TeleBank, the first online and branchless bank.

Its main focus is serving registered investment advisors (RIAs) and fee-based advisors with financial service products that allow them to "sit on the same side of the table as their clients," according to Robert Borgert, Chief Marketing Officer, Jefferson National.

As Borgert explained, RIAs and fee-based advisors hold themselves to a higher fiduciary standard than a commission-based broker, so Jefferson National creates products that add value for the client.

"They add a client value and allow the advisor to sit on the same side of the table so that they can see their clients' money grow," Borgert said.

As a result, Jefferson National has a goal to become a trusted partner to RIAs and fee-based advisors and plans to earn that through continuously innovating the financial services space by developing new products that will serve the unique needs of its customers.

THE CUSTOMER

Jefferson National targets RIAs and fee-based advisors. The company has about 40,000 targets that the company can do business with.

CHALLENGE

In 2005, Jefferson National noticed that there was not a solution for RIAs and fee-based advisors in the tax-deferred space.

For example, tax-deferred products, such as 401Ks and IRAs can be maxed out — a limit imposed to how much can be put into them on an annual basis. Other tax-deferred products, such as very opaque, expensive variable annuities, are sold using fear tactics (i.e., are you going to outlive your money?). They all pay commission to the advisor, which is not how RIAs operate.

With a need in the market that was not being met, the company developed its product Monument Advisor and considered how it would be priced. Traditional variable annuities are priced based on the amount of funds in an account, which eats away the value of tax deferral as the account holder must pay a percentage of that, sometimes up to 3%.

Instead of charging a percent based on how much is in an account every year, Jefferson National rolled out "Flat is Beautiful," which is a flat $20 per month, no matter how much is in a variable annuity account.

"With that, as we were developing our first marketing campaign, we used that as a differentiator and came up with the tagline, 'Flat is Beautiful' because we are the first, and still only, variable annuity that has a low, flat fee, regardless of the account size," Borgert explained.

CAMPAIGN

As Borgert explained, traditional variable annuities and traditional financial services are sold, not necessarily marketed. They are often sold by a field-based wholesale group to advisors. With that, there is a high fee to support a sales structure that is field-based.

"We saw the same thing here. If we cut out the wholesaler and we go to a direct-marketing approach where, one, we move our sales desk internal so they're not out in the field, we don't have that heavy cost associated with that. And two, we bring in a very strong marketing approach via electronic marketing, print marketing, all the traditional means," Borgert said.

By taking this approach, Jefferson National is able to leverage targeting and predictive marketing.

"We could charge less so that the end customer could really experience the value of tax deferral," he added.

Step #1. Internalize the sales process

Jefferson National reformulated its marketing approach to bring the sales group internally to the Louisville headquarters.

The marketing and communications groups total nine individuals, who communicate with advisors several times a week. This includes a team member calling advisors as well as marketing to them.

This includes receiving emails based on activity on the Jefferson National website they have self-identified to have interest in.

One of the challenges that Jefferson National has run into with this model is targeted RIAs and fee-based advisors typically having a poor opinion of variable annuities, due to their complexity and cost.

"Breaking through that bad reputation and showing our customer that there is a better solution for them out there has been somewhat of a challenge," Borgert said.

This challenge was met by developing a better product, the Monument Advisor, and marketing that to advisors to offer clients.

Step #2. Adopt more targeted marketing

When Borgert came on board to Jefferson National, the company was taking a broad approach in its marketing.

Borgert's goal was to take a more targeted approach, implementing predictive marketing along the way as well.

Using marketing tools, an advisor can identify, via a conversation with internal sales, that they're interested in a product, such as fixed income.

Jefferson National has the ability to nurture that advisor around that topic they are interested in.

The team can also track advisors who consume marketing material, which also triggers a nurture as well. These actions could include downloading a white paper or running a tool calculator.

With a more targeted mentality, Jefferson National has been able to cut the sales cycle in half with this approach.

"It's a rifle rather than a shotgun. We've been able to identify where the key predictors of an advisors doing business with us," Borgert said.

Approaching the sales cycle that way, the team has been able to map out the lifecycle of an advisor, step by step.

Step #3. Drive awareness campaigns

Jefferson National uses awareness campaigns to answer the questions: Why do clients need tax deferral? What is really the benefit of having an additional tax-deferred account?

With this comes a variety of messages, including asset location and long-term capital gains.

How this campaign is run is by targeting mainly trade publications with an RIA and fee-based advisor marketer with advertisements.

These advertisements for Jefferson National's unique offering are partnered with email campaigns as well as publication sites.

The awareness campaign is on a very broad scale from a pure marketing, print and electronic, standpoint.

The public relations team also leverages national audience to gain awareness for Jefferson National, such as the

Wall Street Journal.

With this focus, Jefferson National takes on more of a thought leadership position, such as content on trends in the marketplace.

"It's higher level about the benefit that Monument Advisor has in paying off and solving the problem that is the tax-deferred problem. And then we get more targeted on an advisor-by-advisor basis as they identify how they want to consume our product," Borgert said.

The reasoning behind this strategy is backed in research conducted when Borgert came to the team, to help understand what advisors think of the product and think about the problem Jefferson National was trying to solve.

Through this research, the team found that advisors think of Jefferson National in two different ways:

- "I run an investment strategy, and so I need to know how your solution fits within my investment strategies."

- "I have a client who has this need, and I want to know how your solution fits with my client need."

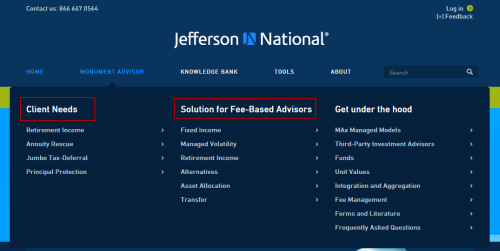

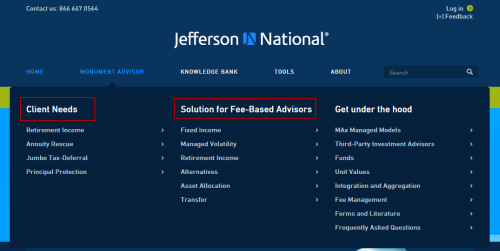

Step #4. Redesign website for awareness and content

At this point, Jefferson National completely revamped the website and positioned Monument Advisor to keep up with the changes.

On the site, the investment solution is broken down by investment solution and client need. This has been purposeful as that was

the way advisors indicated they wanted to consume the product.

Click here to see the full version of this creative sample

The site went live at the beginning of 2014, taking about a year to implement.

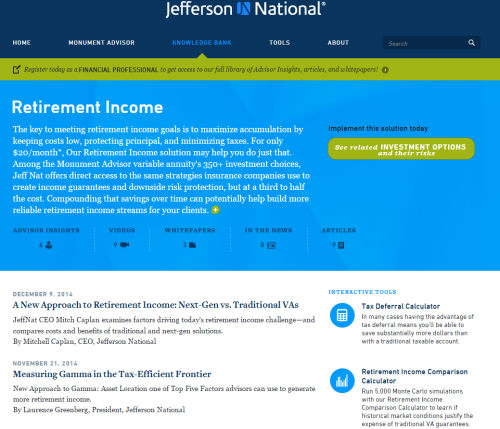

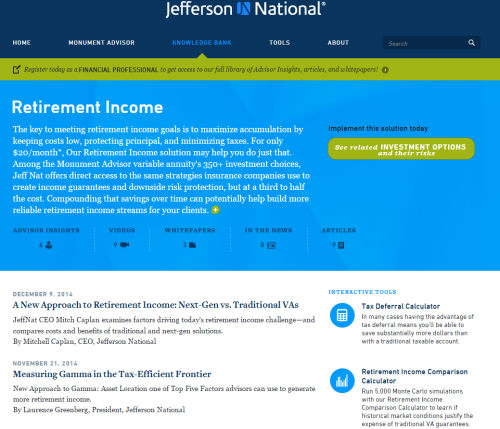

The new site has been successful from a targeting standpoint, allowing the company to make advisors aware of the problem and how Monument Advisor can be a solution.

As prospects come to Jefferson National online and consume content, the team can be much more targeted in how the solution can be implemented into a practice.

Revamping the site's look and feel was also a key goal to the team, and the company leveraged an agency that created the digital experience for the HBO show "Game of Thrones."

"That was intentional as well because we like to think way outside the financial services box. And we really liked the experience — the digital experience — that they were giving to their 'Game of Thrones' viewers. And so we partnered with them to have them help us determine how we can give that same experience to our advisors," Borgert explained.

To fill the site with

targeted content, the team created articles, white papers, videos and tools internally as well through third-party partners.

Click here to see the full version of this creative sample

For example, there are around 400 different investment choices in Jefferson National's platform, which are brought to the company by partners, such as PEMCO, BlackRock and other big investment names.

Jefferson National will go to those partners to help distribute content to advisors.

"What we want is we want to drive value to our end customer, being the RIAs. That value comes in multiple different content forms. And so we publish our fund partner content. We publish our own content. We actually go out and we'll look for industry trends, things that are going on in the industry right now, and we'll

add that to our website," Borgert explained.

Click here to see the full version of this creative sample

Currently, Jefferson National is looking to add a new part of the website that will be aimed at millennials, which has been a big push in the financial services industry, according to Borgert.

"[Millennials] think about things a little differently than Gen X does, and especially Baby Boomers. How do you attract millennials? Not only from an ongoing, 'I have you as a client,' standpoint. But how do you work with the Baby Boomers that have millennials as children to make sure that as they're setting up their legacy and planning for leaving their legacy, that it is going to meet the needs of the millennial as well?" Borgert asked.

This new section will include information about legacy planning to help meet this new need in Jefferson National customer base.

"We're not trying to push product on them. We're trying to be thought leaders and help them conduct the best business that they can conduct," he explained.

RESULTS

"The more awareness you build of your product and the problem, [or] need, that your product is solving, the more that the sales will come," Borgert said.

Since 2010, Jefferson National has seen major increases in growth. Due to its efforts to bring awareness to its unique product and improving the Web experience with content, sales have increased 357% ($175 million to $800 million), and AUM (assets under management) has grown 329% ($700 million to $3 billion).

In addition, Jefferson National had under 900 advisors using its product in 2010, and that has grown to more than 3,000 at the end of 2014.

"That proof point of 3,000 advisors is really important because there isn't another financial services product provider out there that has been able to do that with our target," he said.

Also, before implementing the awareness campaign, the sales cycle typically lasted around six months. Now, Borgert and the team have cut it down to about 90 days.

Furthermore, Jefferson National's sales team has increased from about a dozen in 2010 to 45 at the end in 2014.

Borgert attributes the successes Jefferson National has achieved since 2010 to the fact that the company has gotten to know its customer so much better through customer research and helping them get the information they need.

"As we've been able to develop that trust and to develop the partnership, the sales have come right along with it," he said.

In the future, Jefferson National is evaluating a peer-to-peer referral program, which will be an online portal for advisors to chat in a safe environment and discuss the various products in the marketplace.

The team will also be looking into behavioral segmentation and how that would fit into the B2B financial services marketing strategy.

Creative Samples

- Site design

- Content resources

- Partnered content

Sources

Jefferson NationalBehaviorMarketoSalesforceRelated Resources

Customer Relationship Management: Bring Finance into the CRM worldB2B Project Management: How ATB Financial boosted employee productivity 30%Email Marketing: 133% ROI for B2B's first-ever lead nurturing program