by

David Kirkpatrick, Reporter

CUSTOMER

Fluid power is the process of using fluids under pressure — such as hydraulics — to create and transmit power. Indiana Fluid Power (IFP) sells to targeted accounts: industrial customers, which consist of machine builders that actually build machines to go into manufacturing plants, and mobile customers. Unlike the typical marketing meaning of "mobile," these customers build vehicles or anything that is eventually going to be outdoors and mobile rather than sitting in a plant.

Bernie Clarke, President, Indiana Fluid Power, describes fluid power as the brawn of the organization and the electrical portion — such as electrical automation controls — as the brains of the company's applications.

In order to sell to this specific market, the company has electrical engineers in sales roles reaching out to a target audience of controls engineers, fluid power engineers and purchasers. However, Clarke emphasized that the main target of its marketing and sales is actual engineers who understand these specialty systems and are key decision makers for closing sales.

IFP's average sales cycle is six to 18 months, and its large customers purchase $100,000 or more, yearly.

CHALLENGE

IFP originally sold in northeast Indiana and grew regionally into central Indiana, but the company wanted to expand its reach into all of Indiana as well as additional nearby states.

Clarke explained the team knew IFP had competitors, but its sales team wasn't seeing those competitors. This led Clarke to realize, although the company had its specific region well-covered, it was leaving potential business in other areas untapped.

He said, "We felt we had northeast Indiana pretty well covered, and as you get to central Indiana, you get pretty well covered. But when you get out past these areas, we didn't feel that we had a great understanding of the total available market."

Clarke also realized he didn't want IFP's sales team doing cold calling in the completely new markets for the company, explaining, "If a person has a choice to clean out a closet or make cold calls, [they] will generally decide to clean their closet."

Instead, the decision was made to hire a vendor that specializes in cold calling prospects.

"Rather than having our people do the cold calling, we wanted to go with a professional firm to do it," Clarke said.

CAMPAIGN

Another impetus of expanding into a larger regional marketplace was that IFP had hired three new sales engineers and felt the company had room to grow.

Toward the end of Q1 2014, a senior staff member was completing an MBA at Indiana University and, after speaking with a professor, mentioned some of IFP's business goals. This member's professor recommended a vendor she had heard demonstrated success in lead generation through cold calling.

The vendor selection process was that simple for IFP, so this case study will cover an initial trial run between IFP and the lead generation vendor and how IFP was able to integrate a third-party cold calling a highly technical target audience into its sales and marketing process.

Step #1. Define the prospect

The first challenge in working with the lead generation vendor was helping define IFP's ideal customer so the vendor could pull together a call list. Clarke said an issue they face is that lead gen firms tend to use resources such as Hoover's to search for potential customers.

"They'll put in a SIC code (standard industrial classification) or something like that, or search a type of customer," he stated. "Of those you would come up with 100 customers, [and] 99 of them would not be ideal for us. One would. It's like searching for a needle in the haystack because we're looking for machine builders, not parts manufacturers. But they all get kind of put in together. There is no search for 'machine builder.' It would be nice if there was."

After the vendor conducted a search for prospects, IFP provided them with a "wish list" of companies that IFP wasn't selling to but that they thought would be good accounts.

IFP also provided the vendor with targeted customer lists put together from trade shows and marketing campaigns sending out samples and literature.

The vendor also dug into the details of 10 to 15 of IFP's current clients who were considered "good customers" and used those profiles to help ID similar prospects to enter into the cold-calling campaign.

Step #2. Train the vendor in the industry

Before the campaign could get off the ground, the vendor had to be trained in IFP's specific complex sale and taught details about the highly specialized industry, particularly since the target prospect was likely to be an engineer in the field.

Clarke said, "We did that through basic product and technology training with their people. And I say basic. You don't need to know that much about it, but you need to be able to understand the lingo and the language. And it helps in determining if the customer is going to be a good opportunity or be a good potential or bad potential."

Part of this training was crafting the messaging for email and phone calls and helping the vendor come up with a script.

About the script, Clarke said, "They'd send it to me, and I'd review it and tweak it specifically for what I needed for our industry."

Step #3. Set up the trial program

With prospect lists, training and messaging covered, it was time to launch the trail program with the vendor.

Because IFP targets two market segments — industrial and mobile — the campaign was split into those two segments.

"They use the same type of technology, [but] the needs are different and the actual products themselves are a little different if you imagine indoor versus outdoor equipment," Clarke said.

The two segments had different approaches to business. The mobile segment was more willing to be presented with unique solutions if it solved a problem, but the industrial segment was typically tied into a particular big brand.

"I think [the vendor] found that the industrial has been more difficult than the mobile portion of it, but they're both demanding customers, and they both have serious expectation of how they're expecting you to perform," Clarke said.

He also mentioned the outside vendor lead gen program was set up on a trial basis because IFP — including the sales team — was skeptical someone outside the industry could do the job.

Step #4. Refine the messaging and prospects

Refining the messaging was ongoing, with the vendor sending recordings of some of the early calls so the IFP team could coach that vendor employee on what was done well and what could be improved.

The team also noticed when some prospects wouldn't be good fits, so they would explain to the vendor why those leads didn't fit their customer profile.

Also, when the vendor would get a negative response to an email or phone call, there would be a meeting between IFP and the vendor to go through the specific scenario and refine the messaging to respond to that type of prospect response.

Clarke said, "There was a lot of one-on-one coaching. [The vendor] definitely didn't try to 'cookie cutter' the whole thing and use the same message … it's a very customized message, and, as you might expect as with everything, they get better as they go along and understand how to get past objections."

According to Clarke, eventually the process became the vendor handling 90% of the work on their own and IFP adding about 10% on what could be changed in terms of the campaign messaging.

Step #5. Nurture the prospects

According to Clarke, at IFP, the newer sales team members tend to engage in lead nurturing to help them work with prospects and to also understand the sales process at IFP.

He added that nurturing begins with trying to understand the prospects pain points. The first three nurturing calls are based on building a relationship, uncovering the prospect's products and processes and then uncovering where IFP might be able to solve a problem for the prospect.

IFP defines a qualified lead as someone who will engage past the initial meeting, but the early part of the process is based around understanding the prospect rather immediately going for the sale.

Because of this process, it was important to make sure the lead gen vendor wasn't looking for anything past setting up that initial appointment because IFP's complex sale required more nurturing than a cold call to achieve that final conversion.

Engage new prospects

Because the vendor was able to take the cold call grunt work off the internal sales team's plate, it improved the lead nurturing process at IFP.

"It's really freed our people up to really concentrate on the targets we're going after and also manage their existing business to a greater extent," he said. "It's allowed our sales people, especially the newer ones, to grow quicker than they would have."

The trial run with the vendor also helped to fill the pipeline with new customers. Clarke said a large portion of IFP's business is repeat customers. A goal is to have such a continually growing pipeline that he'd have to hire more sales people to handle both the repeat business and the new prospects coming into the funnel.

RESULTS

A key takeaway Clarke had from this campaign was learning that it's important to have clear messaging, and you can explain that messaging from someone outside the company if you want to engage with third-party vendors for lead generation.

"Specifically, if you are looking at an industry such as ours, we sell technology to companies that buy technology. Most of the targets you're going after aren't sitting around waiting for someone like us to call them. We really need to be able to show value to these people who are extremely busy to be able to get in the door," He said.

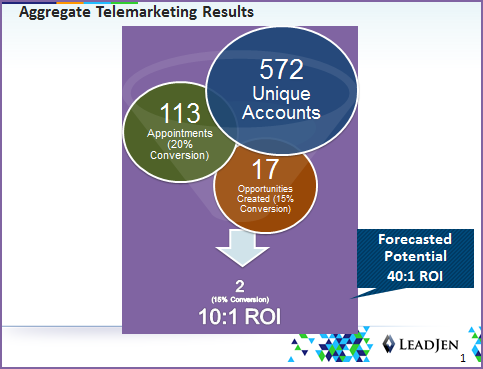

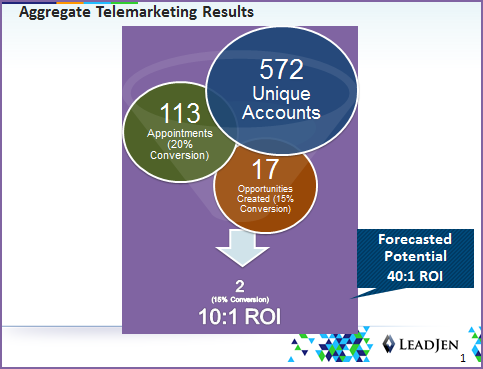

In this case, after a little less than one year, the

campaign achieved:

- 36 appointments over 1,000 phone and email attempts to 150 accounts

- 23% response rate per company

- 15% response rate per person targeted

- A closed deal worth $500,000

- Additional large deals in Indiana Fluid Power's sales pipeline

In terms of expanding its territory, IFP now operates across all of Indiana and in parts of Ohio, Illinois, Michigan and Kentucky.

Click here to see the full version of this creative sample

Clarke did add that the process of utilizing a vendor for lead generation isn't easy, and it's not an overnight solution. However, it does remove the beginning of the sales process from the internal sales team while leaving the rest of the sales process just as it was before the vendor was brought into that process.

Creative sample

- Results chart

Sources

Indiana Fluid PowerLeadJen — IFP's lead generation vendor

Related Resources

Marketing Research Chart: SEO most effective tactic for lead gen, but also among the most difficultB2B Content Marketing: 100% increase in lead gen for customer service software companyLead Scoring: CMOs realize a 138% lead gen ROI … and so can youLead Gen: 17% lift in lead capture by including more details in email [Email Summit 2014 live test]